Income redistribution of transfer payments should be enhanced

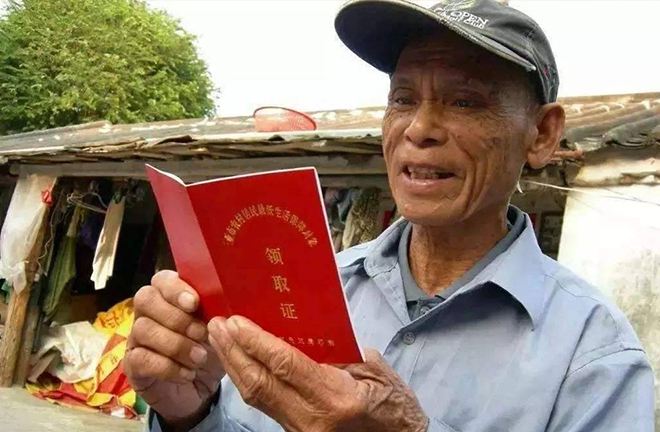

A rural resident reads the certificate to claim minimum living allowances. Providing minimum living allowances for low-income groups is a means of income redistribution by the Chinese government. Photo: FILE

Income distribution has long been regarded as a reflection of social equity and justice, playing an important role in social and economic development. After more than four decades of rapid economic growth, Chinese residents' income levels and quality of life have improved substantially, but the income gap remains large, and it has been widening in recent years. As was pointed out in the report to the 19th CPC National Congress, imbalanced and inadequate development has become the major factor hindering people's growing need for a good life.

The fifth plenum of the 19th CPC Central Committee called for improvements to the redistribution mechanism, increasing the importance of taxation, social security and transfer payments, and reasonably regulating excessively high incomes and banning illegal gains. To narrow the income gap, it is essential to further strengthen the redistributive effect of transfer payments.

Benefiting low-income groups

To curb widening income disparities, the Chinese government strives continuously to make fiscal and policy tools more effective in income redistribution. Public transfer payments are a key approach in this regard. In real life, payments are transferred from the government, enterprises, and better-off residents to low-income families. It is therefore necessary to systematically evaluate the real effect of the Chinese transfer payment system on income redistribution from multiple dimensions.

A host of studies have analyzed the objects that benefit from single-channel relief funds, yet these studies have neglected the systematic and holistic nature of transfer payments. This article starts by considering the perspectives of the government, enterprises, and well-compensated residents, and goes on to study the groups that benefit from Chinese transfer payments.

Meanwhile, it adopts the pro-poor index measurement to re-examine the all-around effects of transfer payments in reducing poverty and income differences between residents. A pro-poor index higher than 1 indicates that the transfer payment is effective in bridging the income gap, and vice versa. The higher the index is, the more benefits low-income groups have received.

It is found that the market revenues gap is the point of departure for analyzing income disparities between residents, and determines the extent of interventions made by transfer payments. The three types of transfer payments from the government, enterprises, and better-off residents have benefited low-income families to varying degrees. Together, transfer payments from all three groups are able to close gaps in market revenues and residents’ incomes.

Among all three types of payments, transfer payments made by the government have the strongest benefits to the poor. Specifically, the pro-poor index of government transfer payments stands at about 2.0, that of payments from non-poor residents is roughly 1.4, and the index of corporate transfer payments is approximately 1.0.

A further categorization of transfer payments reveals the different pro-poor degrees of different benefit programs. Pension, hardship grants and welfare payments from the government are highly pro-poor, and the single child allowance is most pro-poor.

However, the pro-poor index of some programs based on residents' special consumption, such as subsidies for fuel, coal fire, and electricity, is lower than 1.0, and high-income families have benefited more from subsidy programs than low-income households. Given that fuel subsidies take a low share of government transfer payments, the Chinese transfer payment system has evidently reduced the Gini coefficient regarding residents’ incomes, so it is quite favorable to the poor.

The above results suggest that the primary distribution of the market values the output efficiency, while transfer payments from the government, well-compensated residents, and third parties (such as enterprises and social organizations) all aim for social equity and reduced income differences. In general, the Chinese transfer payment system, particularly payments from the government, have positive effects on income redistribution.

Insufficient redistribution

Nonetheless, the scale of redistribution is not big enough. The study measures the redistribution of transfer payments using data from five surveys conducted in the period from 2000 to 2011, and several findings have come to light.

First, transfer payments from the government initially didn't favor the poor, but they gradually became pro-poor, with a growing redistributive effect. In both 2000 and 2004, the pro-poor index of government transfer payments was lower than 1.0, but after 2006, the index was higher than 1.5. In 2011, the pro-poor index of some government transfer payments even exceeded 3.5. All these survey results demonstrate that transfer payments from the Chinese government have been consistently more redistributive.

Before 2006, transfer payments from enterprises mostly were allocated to higher-income groups. Thereafter, the pro-poor index of transfer payments increased and that of some payments exceeded 1.0, but most enterprise payments peaked at only 1.2. This suggests that there is plenty of room to improve the redistribution impact of corporate transfer payments.

Regarding transfer payments from non-poor residents, the pro-poor index didn't fluctuate significantly in the survey years, and results were typically pro-poor. Aid among residents played a strong redistributive role in relieving poverty.

Our research further analyzes the scale of redistribution from multiple levels. Statistical results show that before transfer payments were received, the Gini coefficient in family incomes was around 0.47, while after the intervention took effect, the coefficient decreased by roughly 0.024, down about 5% in the total Gini coefficient. This means the income redistribution effect of transfer payments in China was quite limited.

Based on an analysis of dynamic redistribution trends in different survey years from 2000 to 2011, the rate of transfer payments' contribution to bridging the income gap dropped from 9% to 2%. More notably, the redistributive effect of government transfer payments exhibited a weakening trend, so more efforts are required to enhance the redistribution of fiscal transfer payments.

Improving targeting efficiency

According to existing studies, the current Chinese transfer payment system can effectively benefit low-income groups, but transfer payments account for a small fraction of residents' disposable incomes. This results in the system's unsatisfactory effect in narrowing the real income gap.

While increasing input for government transfer payments, it is particularly important to make transfer payments more targeted. In addition, the participation of third-party sectors, such as enterprises and social organizations, in the redistribution of wealth, is seriously inadequate. The government should provide policy guidance and build institutional environments that encourage third parties to participate.

Efforts are needed to further enlarge the scale of fiscal transfer payments. Studies show that transfer payments from the government are most pro-poor and can significantly improve poor groups' sense of gains. Therefore, increasing transfer expenditures is crucial for China to eliminate poverty and complete the building of a moderately prosperous society in all respects.

It is especially vital to improve the targeting efficiency of funds for transfer payments. The Chinese transfer payment system is effective in targeted poverty alleviation, but the targeting efficiency varies with different types of expenditures. Thus attention should be paid to optimizing the internal structure of fiscal transfer expenditures.

Furthermore, the government should play a bigger role in policy guidance and institutional environment building to enhance the participation of third-party organizations in wealth redistribution. This study finds that apart from fiscal transfer payments, payments from enterprises and high-income families have also benefited poor and low-income groups.

Regrettably, the participation of third-party sectors in rural poverty alleviation is insufficient, so the government should further encourage third-party participation to guarantee the basic living of the impoverished population.

As the building of a moderately prosperous society in all respects is about to be completed, policymakers should beef up efforts to close the income gap. Strengthening the redistributive effects of fiscal transfer payments based on the current rural transfer payment system, and rallying forces of enterprises and social organizations to create a sustainable income guarantee mechanism for the rural low-income population and effectively alleviate urban-rural income disparities are also themes of China's 14th Five-Year Planning (2021-25).

Lu Shengfeng is an associate research fellow from the Center for Economic Development Research at Wuhan University; Chen Sixia is an associate research fellow from the School of Public Finance and Taxation at Zhongnan University of Economics and Law; Shi Liangyan is from the Economics and Management School at Wuhan University.

Edited by CHEN MIRONG