Promoting reforms of how goodwill is handled in accounting

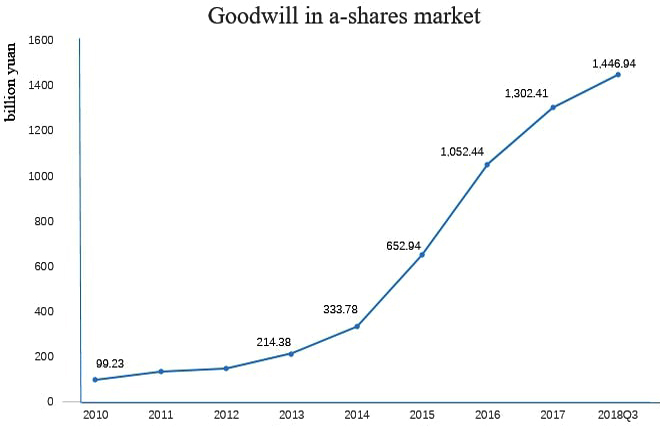

As of the end of the third quarter of 2018, the total size of goodwill in China’s a-shares market reached about 1.45 trillion RMB. Source: GELONGHUI

Goodwill in accounting refers to the difference between the purchase price used to acquire a company and the fair value of the net assets of the acquired company. In theory, accounting generally takes the goodwill as a company’s excess profitability comparing to its counterparts, and it is an unidentifiable asset. As of the end of the third quarter of 2018, the total size of goodwill in China’s market reached about 1.45 trillion RMB.

Currently, the biggest problem with the goodwill is confirmation of the Mergers and Acquisitions(M&A) premium. Liu Feng, a professor of the Institute for Finance and Accounting from Xiamen University, said that theoretically, the M&A premium represents the excess profitability of the acquired company. However, it may also include non-relevant factors caused by weak ability to negotiate or bargaining ability, the excessive optimism of the acquirer, and other possible agency conflicts—these actually have nothing to do with excess profitability. Futhermore, the excess profitability of a company may not be confirmed as goodwill because there is no specific and identifiable reliability test. This may lead to underestimation of a company’s goodwill. However, there is no need to worry too much about the high goodwill observable in the current Chinese capital market. According to effective market theory, investors should be able to see through those disguises.

According to efficient market theories, a highly efficient capital market does not welcome the huge goodwill formed by irrational mergers and acquisitions, and it can distinguish whether this kind of goodwill has a real economic significance. However, Huang Shizhong, director of the Xiamen National Accounting Institute, said for the moment, the effectiveness of the capital market is only a semi-strong form of efficiency. Therefore, considering the long-term healthy development of the capital market, we should not stop goodwill reform because of pain in the short-term; otherwise accumulated non-rational goodwill will trigger systemic risks and hit the capital market in the long run.

Huang added that from a macro perspective, goodwill amortization is fairer than goodwill impairment, and it will encourage more cautious M&A. Therefore, goodwill amortization is more conducive to market stability in the long-term. Since goodwill is subjective and arbitrary to a certain degree, the goodwill impairment test is not in line with the principle of cost-effectiveness. It is difficult for accountants and regulatory authorities to judge the reasonableness of the test and provision of goodwill impairment. Mandatory goodwill amortization can reduce the subjective randomness of goodwill impairment, avoid the use of subjectivity to manipulate profits, and help companies reduce the risk of excessive gaps on their account books due to blind M&A.

Xie Deren, a professor of the School of Economics and Management of Tsinghua University, said that goodwill impairment or amortization should be considered based on the financial statement system and the revenue recognition principle. In accordance with the logic and development direction of current accounting standards, goodwill should not be amortized, but continue to use the current impairment test. As for the phenomenon that goodwill impairment is manipulated by the company and the auditor, it is a matter of inadequate supervision rather than the accounting standards themselves. In terms of practical problems in the accounting of goodwill, considering the chaos involved in the current financial accounting transition, from centered on the profit statement to centered on the balance sheet, we can also regard goodwill as a “funds bank” to use annual amortization or one-off processing.

Liu added that the stable, sustained and healthy operation of a company and its ability to create cash flow are the foundation of corporate development. At present, enterprises should pay more attention to their economic development. Under current accounting standards, any revision of the standards will take a long time. Therefore, we can start with exposing more off-statement information. Through more detailed information, investors and other statement users can better understand the specific content represented by corporate goodwill.

(edited by MA YUHONG)