China ranks second in ODI for the first time in history

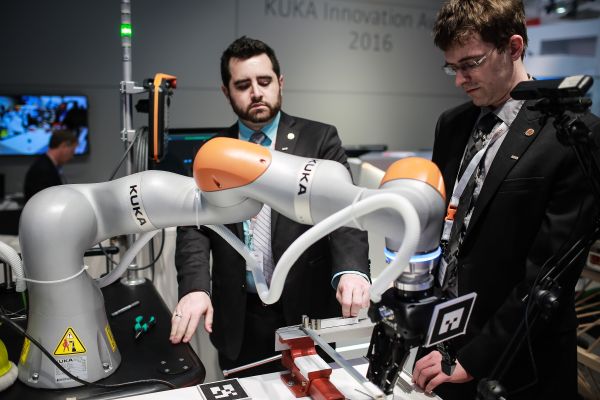

Workers demonstrate a robotic arm manufactured by the German Kuka Robot Group, one of the leading robotics companies in the world, which Chinese household appliance maker Midea Group Company is buying.

In 2015, China ranked second globally in terms of outward direct investment for the first time in history and was surpassed only by the United States, according to a report released by the central government on Sept. 22.

China’s ODI hit an all-time high of $146 billion last year, exceeding foreign direct investment by nearly $10 billion, according to the 2015 Statistical Bulletin of China’s Outward Foreign Direct Investment, jointly released by the nation’s Ministry of Commerce and other departments.

Fan Zengqiang, an economics professor at Shanxi Normal University, said several factors have contributed to the strong growth of ODI, including simplified procedures as well as the favorable environment fostered by the nation’s “Belt and Road” initiative.

Other reasons for the surge in outward investment include new technologies and opportunities created by economic restructuring globally and excess production capacity domestically, Fan said.

China’s international economic activities are no longer mostly confined to trade, said Lu Jinyong, an economics professor at the University of International Business and Economics, China. Enterprises are beginning to compete globally, diversifying into the fields of finance, manufacturing and high-tech industries, Lu said, adding that non-public companies in particular have emerged as a significant source of China’s ODI.

Lu said the trend of going global will encourage the development of Chinese multinationals, which will likely lead to a global value and industrial chain dominated by Chinese companies. It is an important way to cut excess production capacity in China and optimize the nation’s industrial structure, he said.

The “Belt and Road” initiative provides a favorable external environment for Chinese companies to go abroad, and they may actively engage in international competition within domestic and foreign markets, said Lu Tong, a research fellow from the Institute of World Economics and Politics at the Chinese Academy of Social Sciences.

“In order to establish a global value chain featuring strong Chinese companies, we should accurately assess the position and competitiveness of different industries, and actively participate in the deep integration of global resources,” Fan said.

The “Belt and Road” initiative might help the outward extension of China’s production capacity and industrial chain. A Chinese company could allocate and utilize resources more efficiently through the establishment of its own production and marketing system, Fan said.

When preparing a strategy to do business abroad, each company should comprehensively assess its own position within the industry, Lu Tong said. A company’s success depends on such factors as a proper international competition strategy, the right target market, suitable channels for investment and transnational management, and last of all, a successful adjustment of the company’s organizational structure to its management strategy, she said.

In regard to risk prevention and management, Fan said companies should adopt a localized strategy and strengthen their sense of social responsibility, which means economic issues as well as social, environmental and political issues should all be taken into consideration.

And the government should establish a more balanced, stable, transparent and predictable international investment system by speeding up negotiations on multilateral investment agreements and further promoting the “Belt and Road” initiative, Fan said.