Seismic effect of big data ushers in new economic cycle

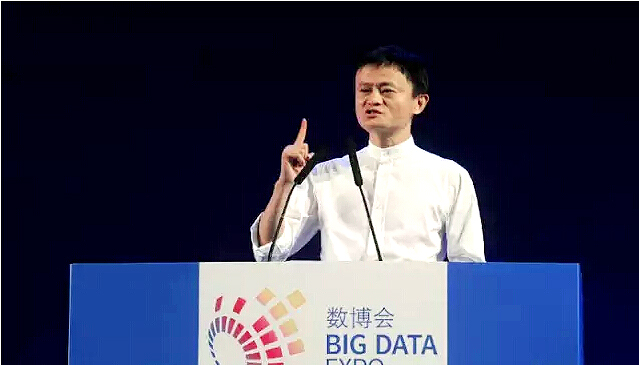

Jack Ma, the founder and chairman of Alibaba Group, gives the keynote speech at Big Data Expo 2015 in Guiyang, Guizhou Province, on May 26.

Since the 17th century, societies have been transformed by five technological revolutions. Each revolution ushered in a ground-breaking, leading-edge technology and a radical paradigm shift in several interconnected realms of industry. A combination of new technologies reshaped organizational modes of production, consumption and daily life. In concrete terms, human beings reinvented production processes to maximize profits and minimize costs, leading to changes in social organization, behavioral patterns and spending habits. This is the quintessential logic of techno-economic transformation.

Six revolutions

The first technological revolution started in the 17th century and continued through to the mid-18th century. It laid the basis for a modern techno-economic paradigm completely different from agricultural civilization, which was characterized by manual labor, a diffused and fragmented society, and a self-sufficient mode of living and production.

The introduction of steam engines and railroads signaled the start of the second technological revolution, which lasted from 1760 to 1840. Stagecoaches gradually disappeared. A modern postal system came into being, and the cost of land transportation decreased, stimulating inland trade and other forms of exchange.

Lasting from 1870 to the start of World War I, the third technological revolution brought with it the mass production of steel, electricity and heavy machinery, reducing production costs and ushering in an era of large-scale manufacturing and electrification.

The fourth technological revolution, which also began in 1870, led to the mass production of petroleum and automobiles. The petrochemical industry became the cornerstone of many other modern industries as well as the root of the carbon-intensive model of production that remains entrenched to this day.

There is no clear line separating the third and the fourth technological revolutions. Together, they gave rise to full-blown industrialization, with its grand scale as well as its standardized, streamlined mode of production and organization.

The fifth technological revolution started with the introduction of the Intel 4004, a 40-bit central processing unit, in 1971. Since then, personal computers have become commonplace in all societies, allowing users to process an astronomical amount of information. As an independent production factor, information has become increasingly vital to socioeconomic development, breeding a knowledge and information economy as well as economies of scale and flexible manufacturing.

The sixth technological revolution is synonymous with the “big data revolution,” which emerged around 2010. Its main components are the Internet of Things, cloud computing and big data technologies. Information and communication technology might be the new gravitational center. Personalization, customization, distribution, network, intelligentization, integration and servitization are the key words of the ongoing revolution.

New powerhouse

In 2014, Chinese President Xi Jinping introduced the concept of the “new normal.” Under the “new normal,” domestic economic growth will decelerate and stabilize at a moderate-to-high level. Facing acute downward pressure, the Chinese economy is likely to slide into the “middle-income trap” without a new source of growth.

Big data technologies can be the new powerhouse of economic growth. They drive the formation and renovation of industrial chains and innovation ecosystems. Made up of information technology manufacturing, cloud computing and the Internet of Things, the information industry is a substantial component of the big data economy and China’s GDP. From 1977 to 2012, 3.42 percent of GDP growth was stimulated by capital related to information technology. From 2010 to 2012, the IT industry contributed to 10 percent of GDP growth.

Additionally, big data technologies will make traditional industries more efficient by drastically accelerating the course of information collection, processing and feedback. Subsequently, production factors, such as capital and labor, will also be optimized. Ultimately, society will become more efficient. Productivity will surge, and total factor productivity will increase.

Economic cycle

The unfolding of the big data revolution has also galvanized the energy sector and the field of material science. As groundbreaking innovations proliferate, a new industrial revolution and technological repertoire are on the way, foreshadowing a new, sustained cycle of economic growth.

According to German-American economist Joseph Schumpeter’s (1883-1950) theory of business cycles, every technological revolution goes hand in hand with a business cycle lasting 50 to 60 years. Similarly, Soviet economist Nikolai Kondratiev (1892-1938) proposed the concept of “supercycles” that continues for 48 to 60 years, using statistics of the British, French and American economies. How can the existence of economic cycles be explained? To start with, it takes time for society to embrace and adopt new technologies and for old ones to be phased out. Afterward, massive investment demands will follow. Factors of production will swarm into the newly emerging sector while consumption patterns will be altered, giving rise to more demand and stimulating the economy. Schumpeter and Kondratiev’s studies were confined to economic development in the West before the 1930s. Thereafter, the global economy continued to grow in a cyclical pattern, but the average length of each cycle decreased to 40 years.

The interval between a disruptive technological breakthrough and the onset of an economic cycle ranges from 10 to 20 years. Based on this assumption, it can be predicted that a new wave of economic growth powered by big data technologies will begin around 2020. Riding this tide, the Chinese economy will be on the fast track to upward development. The entrepreneurial boom that started in the 2012 might be the prelude of the next economic cycle.

Cai Yuezhou is a research fellow from the Institute of Quantitative and Technical Economics at the Chinese Academy of Social Sciences.

Link

In 1862, French economist Clement Juglar (1819-1905) first proposed the fixed investment cycle of seven to 11 years. Building on Juglar’s observation, Schumpeter formulated a more elaborate theory of business cycles in the 1930s. According to his History of Economic Analysis, a business cycle consists of four stages. The stage of expansion is characterized by an increase in production and prices, as well as low interest rates. The stage of crisis is punctuated by stock market crashes and a series of corporate bankruptcies. The stage of recession is marked with declines in prices and outputs as well as high interest rates. The stage of recovery is driven by stock market rebound.

The notion of “supercycles,” or “Kondratiev waves,” also shed light on the oscillation of the modern world economy. The span of a supercycle ranges from 40 to 60 years, consisting of three phases: expansion, stagnation, and recession. In his book The Major Economic Cycles, Kondratiev divided the development of the modern world economy into two long periods: 1790-1849 with a turning point in 1815 and 1850-1896 with a turning point in 1873.