National saving rate fluctuates as aging population grows

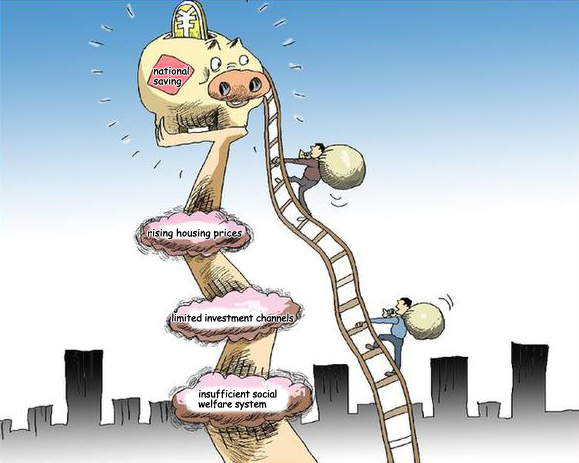

Though China’s population continues to age, the national saving rate has remained steady because of rational behavior and the tendency to save for a rainy day. The saving rate is also affected by other factors, such as rising housing prices, limited investment channels and an insufficient social welfare system.

The strict family planning policy China has had in place for the past few decades has brought about a sharp decline in the birth rate, drastically altering the demographic structure.

At the same time, rapid economic growth, rising living standards and advancements in medical technology have increased the average life expectancy. Now, at the dawn of the 21st century, China is facing challenges posed by an aging population.

China’s population is aging at a rate nearly twice as fast as that of developed countries. It is estimated that people aged 65 years or older will account for roughly 30 percent of the nation’s total population by 2050, matching the proportion of senior citizens in developed nations.

There is great variation in the degree and pace of population aging in different areas. On the whole, the problem of population aging gets progressively worse as one travels from the underdeveloped west to the relatively more prosperous east.

Status quo

Many fear that the rapidly aging population will tax social resources and eventually hinder economic growth.

According to the life-cycle hypothesis, the very young and the elderly tend to save little or draw on savings to pay for current expenses, while middle-aged people tend to save more. The aggregate saving rate decreases as ranks of the first group swell and the second group shrinks. If this is true, China’s national saving rate will decline as the population ages.

However, the national saving rate is still on the rise, and it hit nearly 52 percent in 2012, an almost 13 percentage point increase from 12 years earlier. Moreover, the regional differences among the saving rates in eastern, central and western China appear to have a statistical relationship with the pattern of population aging. The level of population aging in a region is positively correlated with the saving rate, contradicting the predictions of the life-cycle theory.

In addition, the changing pattern in saving rate varies among different regions. From 2000 to 2012, in eastern China, where seniors account for a greater proportion of the overall population, the regional saving rate rose relatively slowly—less than 5 percent within 12 years. In some places, such as Beijing, Shanghai and Zhejiang Province, saving rates even declined. In contrast, western China has the lowest regional saving rate, but it increased by 14 percent in the first 12 years of the 21st century, outpacing that of any other region. In central areas, the saving rate also went up by more than 13 percent.

The variation in saving rates within one region may be tied to uneven population aging, while the discrepancies among regions may be associated with the regional economic disequilibrium, which seems to imply a more complex relationship between population aging and the national saving rate. This paper is intended to delve into this particular matter.

Burden, life expectancy

Existing theoretical models and empirical analysis of transnational data have shown that population aging exerts two opposite effects on saving rates—burden and life expectancy—but it is rare to find literature or in-depth research on the two effects in China.

In reality, the regional discrepancy of China’s population aging process provides a broad ground to collect data and examine the burden and life expectancy effect at different stages.

In the standard life-cycle model, rational consumers will allocate their consumption and savings in accordance with their total expected personal or household income to maximize their earnings’ effectiveness throughout their life cycle. It is common for rational consumers to save part of their income in adulthood for future consumption in old age.

Therefore, individuals tend to save more in their youth and less as they grow old while the aggregate national saving rate is determined by the age structure. As the proportion of the senior population rises, the national saving rate will go down accordingly. This article defines the negative impact population aging has on aggregate national savings as the “burden effect.”

To a large extent, the life cycle-theory overlooks a fundamental fact—national saving rate is also affected by increasing life expectancy.

An excessive population burden will increase the number of people who dip into their savings relative to those who save, resulting in a downward trend in total savings and saving rate. However, mankind’s reasoning capacity has a say in the redistribution of economic resources and the coordination of acts of the life cycle, meaning that the assumptions of the life-cycle theory may be plausible.

In fact, when rational consumers expect longevity, they often take the initiative to adjust their saving and consumption behavior in case of a “rainy day.” Such a motive may bring a rise in saving rate, which is the “life expectancy effect” of population aging.

This article adopts a three-period overlapping-generation model that takes into consideration both the burden and life expectancy effects to carry out a theoretical analysis of the scenario and empirical research using provincial panel data.

A large body of empirical literature shows that the tendency to save for a rainy day brought by an extended life span can explain the upward trend of the national saving rate in China as well as the discrepancies among regions. In contrast, the burden of the growing senior population has not apparently taken a toll on the saving rate, nor the variations of it in time or among regions.

Based on the results of empirical research, this article predicts the trend of the 2015-2050 regional saving rates in China. As population aging accelerates, the positive effect of life expectancy will run out, whereas the burden effect will be amplified, shifting the landscape of population aging.

Under the joint influence of demographic and economic factors, eastern and central China will see a rapid decline in saving rates starting from 2015, while western China will reach a turning point around 2030, eventually leading to a diminishing, even a reversed margin among regions.

Going forward

According to the forecast, population aging will have a huge impact on China’s national household saving rate and regional discrepancy in the coming decades, so industrial and regional planning policies should be adjusted correspondingly.

First of all, due to the burden effect, the national saving rate will climb slowly to the peak and then begin to decline.

On the one hand, reduction in national savings will cause the domestic funding supply to tighten. Some industries and enterprises are likely to face a capital chain break. This requires governments at all levels and financial institutions to implement differentiated industrial policies to ensure that limited savings flow to dominant industries, eliminating excess capacity and backward industries and promoting industrial restructuring and upgrading.

On the other hand, the decline in national saving rates would affect incremental capital, diminishing capital accumulation and economic growth. However, as the economy expands, slowing growth complies with objective economic laws as well as the necessary adjustments of industrial transformation. In this light, China’s ongoing economic restructuring, which stresses balancing the pace and quality of economic growth, represents not only a period of reflection after decades of extensive growth but also a transition in line with future changes in the age structure.

Second, the forecast also shows that in the next 30 to 40 years, the gap among regions will narrow in terms of population aging and the discrepancy in saving rates. Since the national saving rate and economic growth are positively correlated, such a shift could lead to regional economic growth convergence.

It is evident that the interregional convergence of saving rates is merely a first step in narrowing the economic gap among regions. In order to achieve balanced interregional economic development, a differentiated development plan built on individual characteristics must be mapped out. For example, in the east, the tertiary sector and high-tech industries should gradually replace labor-intensive industries. Central and western regions, where per capita income and industrialization still lag behind, should seize the opportunity of industrial transfer and develop a new type of industrialization.

Wang Wei is from the Institute of Finance and Economics Research at Shanghai University of Finance and Economics. Ai Chunrong is from the Institute of Statistics and Big Data at Renmin University of China.

PRINT

PRINT CLOSE

CLOSE